Aura Review

What is Aura?

No matter how careful you are on the web, you may become a victim of identity theft. This occurs when another person finds enough financial and personal information about you that they can open accounts in your name. You might find that someone opened a credit card under your name or used your identity to secure a car loan. It can take more money than you expected to fix the problem and can stop you from opening new lines of credit or using credit that you already have. Hackers can gain access to your information through phishing websites and data breaches along with other methods.

Aura is a company that claims it can keep you safe from hackers and other threats. You can pick a plan that includes theft and fraud protection that protects your personal information and finances. Aura offers three plans that start at just $10 a month to keep your accounts secure. You’ll receive alerts if the company notices changes to any of your accounts and find ways to protect your wireless devices at home. Users also get $1 million in coverage if anyone uses your information. Before you sign up for one of these plans, check out our Aura review to see how much you will pay and what you get for your investment.

With Aura, you get a VPN and protection against phishing sites as well as identity theft protection

- Compatible with computers and mobile devices

- Reimburses you up to $1 million

- Includes tools to keep you safe on the web

- Monitors the web for your name and account information

- Lets you choose a plan with the right protection

- Only gives you one credit report per year

- No guarantees offered

- Is more expensive than some plans

With three plans available, Aura makes it easy to choose one that fits your budget and lifestyle. You get a VPN and protection against phishing sites as well as identity theft protection and reimbursement of up to $1 million.

iReviews Shopping Assistant

Find the best prices for this and many other products with our chrome extension

Product Features

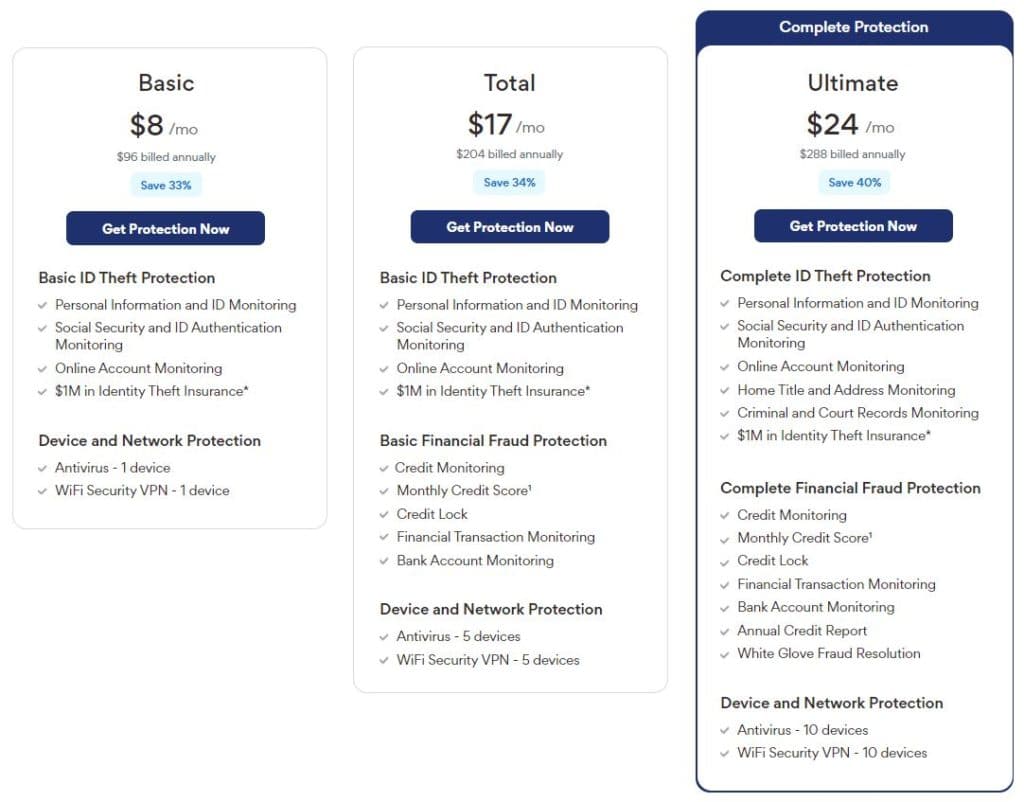

- Price: $10/month for the Basic plan, $20/month for the Total plan, $30/month for the Ultimate plan

- Insurance and Reimbursement Coverage: $1 million

- Credit Report: Yes, once per year

- Credit Score: Yes, once per month

- Device Protection: One to 10 per plan

- Customer Support: 24/7

How Can You Use Aura?

To use Aura, you need to visit the website and look over the three available plans. The Basic plan is the cheapest but only includes some minor forms of protection. With the Total plan, you get more protection that works on five devices. There is also the Ultimate plan. While this is the most expensive, it’s worth the price as you get protection for 10 devices and full access to all of the Aura features. Once you become a customer, you can download the Aura app and use it on your Android or Apple device. You’ll then have the chance to pick and choose from different features to get the protection that you need. Some of the things that you can do with Aura include:

- Get fraud alerts that tell you when changes occur that might make you a fraud victim.

- Set limits on how much you want to spend with different accounts and get alerts when you reach those limits.

- Receive updates that tell you how your credit score changed over the last month.

- Design a watch list to see when your name appears in different ways online.

- Protect your computer and other devices from malware such as spyware and adware.

Aura offers an app that is compatible with most smartphones.

Where Can You Use Aura?

When you download Aura, you’ll find that you can use it anywhere that you go. You can use it while you’re relaxing at home on the weekend to make sure your accounts are in good standing. It’s also easy to use the app if you’re in the middle of a long day at work. You can even use it as you run errands or spend time with your loved ones. You have the chance to set up alerts and learn about problems as soon as they happen. Aura might tell you that someone just took money out of your savings account or moved money to a different bank.

If you choose the Ultimate plan, Aura will serve as antivirus software for up to 10 devices. The two other plans include antivirus protection for a single device or up to five devices. This keeps you from picking up different types of malware when you download a game or check out a new website and helps you ensure that your wireless connection is secure. Aura can tell you when someone attempts to use your network such as a neighbor. As long as you have internet access, Aura will go where you go.

Get protection that is easy to use on your devices with Aura.

Who’s This For?

We recommend Aura for anyone concerned with identity theft. In the hit film “Identity Theft,” Jason Bateman played a man tracking down Melissa McCarthy after she stole his identity and left him in debt. While the film took a humorous approach to identity theft, the problem is much more serious. It costs people just like you billions of dollars a year. You may not realize that law enforcement will not investigate unless they have clear evidence or that some institutions won’t offer much in the way of help. With Aura, you get all of the help that you need before someone steals your identity.

This is also a handy app for those worried about financial fraud. All it takes is a single hacker who uses your bank account for you to lose hundreds of dollars or more. Aura will protect you against some of the common frauds found today and keep an eye out for those that might appear in the future. You also get a virtual private network (VPN) that you can use in and out of your home along with antivirus software. As a bonus, Aura gives you up to $1 million in coverage if you lose money due to identity theft or fraud while using the app.

Aura offers all of the protection that you need, even if you’re on the go.

Signs of Identity Theft

Before we look at how Aura protects you from identity theft, let’s take a look at some of the signs that you might notice. One sign of identity theft is when you no longer get mail from your bank or credit cards. Thieves will often update your address to prevent you from getting warnings and alerts that you opened a new credit card. You may notice off things relating to your bank account such as money taken out at an ATM or moved to a different account. Identity thieves can make fake debit cards that work at an ATM without needing your real card.

Another sign is when you get bills that list your name but do not belong to you. A common example is a medical bill. The thief may use your identity at an emergency room to receive care. Due to the information received, the hospital will bill you for the cost of the care given. You may get a notice from the Internal Revenue Service (IRS), too. Many people receive notices when the IRS receives two tax filings for the same person. This may occur because someone sold your identity to an illegal worker. Whether that individual files taxes or their employer does, it will come back to your name.

A lack of credit card bills or getting bills from a card you don’t have can be signs of identity theft.

How Does Aura Protect Against Identity Theft?

Though there are quite a few reasons to use Aura, most customers like the identity theft protection that they get. A recent report found that shops and websites experienced data breaches that led to the loss of more than 37 billion records across nearly 2,000 websites. The Federal Trade Commission (FTC) found that the number of identity theft cases in 2020 doubled from those reported the previous year. If you want to make sure that you stay safe and do not become a victim of identity theft, you’ll like some of the ways that Aura protects you.

Secure All of the Accounts You Use Online

One way in which Aura protects you is that it will secure any and all of your online accounts. If you’re like most people, you probably use a handful of accounts every day. While some of these don’t contain personal information, many do. When a thief uncovers the login information you use on one site, they can often unlock other sites and find out more about you, which they use to steal your identity. Aura will monitor your online presence and let you know if it finds any compromised accounts such as someone using your account from another state or trying multiple times to enter your password.

Social Security Number Monitoring

To work and pay taxes in the United States, you must have a social security number (SSN). You need to use that number when you apply for a loan or open a new bank account as well as when you start a new job. Aura offers SSN monitoring that can identify different things, including when someone uses your SSN to open a new bank account or apply for a credit card. You can go into your account and authorize the notice to let Aura know that it was you. Aura can also alert you to wire transfers made to send money across the country or to another country via your SSN.

Watch Public Records

Criminals can use your identity to avoid criminal charges. Let’s say that someone gets pulled over during a routine traffic stop with marijuana in their vehicle. They can give the police your name and address. When they post bail, the police may come after you. You risk police knocking on your door with a failure to appear warrant for a charge in criminal court in a completely different state. Aura monitors public records and can let you know when your name appears in a court case. This helps you notify the court that you were a victim of identity theft and avoid possible criminal charges.

You can avoid criminal charges through the public records monitoring that Aura offers.

How Does Aura Prevent Credit Card and Financial Fraud?

According to the FTC, financial and credit fraud increased by 27% from 2019 to 2020. The government agency also found that fraud victims experienced more than $3 billion in financial losses due to that fraud. Victims also reported more than 20% more cases of credit card fraud between 2019 and 2020. Though credit card fraud can occur when someone uses your card without your permission, it often involves serious cases that go along with identity theft. If you want to make sure that the company does not hold you responsible for the money spent on that card, make sure you look at how Aura prevents credit card and financial fraud.

Real-Time Monitoring

When you become an Aura customer, you get real-time monitoring of your credit report and financial accounts. Aura pays special attention to any recent requests to view your credit report. In addition to your credit score, thieves often use your credit history to apply for new loans. As long as the company has your name, date of birth, home address and SSN, they believe that the thief is you. An inquiry into your credit report is a clear sign that someone wants to use your identity. Aura will notify you as soon as they find a new inquiry and can find issues up to four times faster than similar services can.

Suspicious Spending Alerts

Aura also offers suspicious spending alerts that let you know when one of your accounts experiences anything unusual. Let’s say that you have a checking account that you use to pay the same bills every month. Aura may alert you when it finds a new bill paid with that account. Another example is a credit card that you use to cover your daily expenses. Aura will send you a message if someone uses that card to take out a cash advance. Thanks to spoof cards, thieves can now access your bank account, even if they don’t have the original card or live in your city. Aura notifies you of any suspicious activity it sees.

Credit Report Support

You’ll also find that Aura can help when it comes to your credit report. The top three credit bureaus base your credit score on factors such as your ratio of debt to income and the number of accounts you have. Your credit report features a full history of organizations that viewed your report and any payments that you made late or skipped. Aura offers regular monitoring of your credit report. As you can usually only get a free copy of this report a few times a year, Aura lets you know about issues that you might not see until later in the year.

With Aura, you can get help with your credit report via any computer or mobile device.

Why Use Aura for Credit Monitoring?

You have the right to request a copy of your credit report for free once every 12 months. As there are three main bureaus that offer this information, you can get a copy every four months. Unlike your credit score that is just a number, your credit report goes into more depth about your financial history. It can help lenders determine whether you are a good credit risk and loan you money or let you take on debt. Thieves can use your information to open new accounts in your name. There are a few reasons to use Aura for credit report monitoring, including:

- Aura lets you see how your credit score increased or decreased every month, which can let you know if someone took on new debt in your name.

- You can use Experian to lock your credit file whenever you want. If a lender tries to view your record, this will stop them. It’s a helpful tool if you were a victim of identity theft or noticed any suspicious activity.

- Aura monitors all three of the top credit bureaus. Unlike similar services that only monitor one or two, Aura monitors all three and can let you know about issues that others missed.

With daily credit monitoring, Aura finds issues with any of the three bureaus.

What Device and Network Protection Does Aura Offer?

Getting protection for your devices and home network is important because security issues leave you vulnerable to thieves and hackers. Whether it’s someone across the country who gets past your firewall or a neighbor down the street who downloads videos without your permission, those threats leave you at risk. Experts find an average of 350,000 new types of malware every day that attacks people and networks. From 2019 to 2020, the number of phishing sites rose by more than 20%. If you want to protect your home network and keep your family’s devices safe, it’s helpful to look at some of the ways that Aura can help.

Antivirus Protection

You leave your system and network vulnerable when you do not have antivirus software. Aura offers antivirus protection that works just as well as the top programs do. Your software comes with features that automatically look for any malware that you come across and will block it. Aura will detect viruses and quarantine or isolate them to keep your computer safe. You can use this protection on mobile devices, too. Aura works against all kinds of malware such as ransomware and trojan viruses as well as adware and spyware. The number of devices you can protect depends on the plan that you choose.

WiFi Security

Many people do not think twice about using their home WiFi to do different things on the web such as transfer funds from their bank account or pay their credit card bills. If your wireless network isn’t secure, you’re vulnerable to people who can steal your information when you use the web. Aura lets you use the same level of protection that the military does to stay secure. It will tell you when your connection is secure, which means that no one else can access it. Aura also shows if your location is masked, which means that others cannot track you.

Avoid Online Scams

Phishing sites rely on users not paying attention when they click links. You might get an email that looks like your bank sent it, which asks you to log in with your username and password. It’s only when you look close that you realize it’s a similar site designed to steal your information. Aura uses software that allows it to block more than one million sites that its users try to visit every day. It will block the site and issue a warning that lets you know why you can’t load the page. Aura is effective at blocking the top phishing and scam sites on the web.

Aura keeps you from visiting websites that use spoofs to steal your usernames and passwords.

What Types of Malware Does Aura Protect Against?

Aura offers protection against all of the malware you see on the web today and those that you might come across later. One example is ransomware. You can download ransomware at the same time that you download a new app or game. This type of malware involves some type of threat. For example, it might claim that it will release photos from your hard drive unless you pay a certain amount of money. Hackers who use ransomware can hold your computer or device hostage and block you from doing anything with it until you pay the money they demand. They may ask for gift cards in lieu of money, too.

You also get protection from spyware, which comes from hackers who use it to look at files on your system. Spyware is dangerous because it gives a remote user complete access to your system and anything saved on your hard drive. This allows them to view all of your saved usernames and passwords, too. Aura even offers protection against adware, which is more annoying than dangerous. It causes ads to appear every time you use your device. You may need to watch an ad before loading a game or find that ads run in the middle of videos. Aura offers the ultimate protection against malware.

With Aura, you get protection for all of your devices against all hazards.

What are the Common Credit Card Frauds?

As an Aura customer, you get the protection that helps you avoid becoming a victim of credit card fraud. While you might think that this type of fraud only occurs when someone steals your card out of your wallet or purse, it can take many different forms. The official and legal definition of credit card fraud is that a person gains access to a line of credit that you have and uses it without your permission. We recommend taking a look at some of the common types of credit card fraud that Aura can protect against.

Phone Fraud

One example is phone fraud, which is when someone calls and asks for your credit card information. Hackers often claim that they work for a government department. They might state that they are from the IRS and that you need to pay your back taxes right away before the IRS puts a lien on your home or bank account. The IRS offers payment plans and will notify you if you owe money. This agency will never call you on the phone. Phone frauds can also involve hackers who say that they work for local law enforcement and that you need to hand over your credit card to avoid a warrant.

Swipe Cards

Credit cards have a magnetic strip along the back that supplies your information. Hackers often use card readers that they install on gas pumps and vending machines. When you swipe your card, the reader makes an imprint, which they can use to copy your card. They then get a card that looks real and works the same way that your card does. Many credit card companies now use chips in place of magnetic stripes. If you have an older card, you might request an upgrade to a chip card. Aura monitoring lets you know if someone used your card in a suspicious manner to alert you that you were a victim of this scam.

Mail Fraud

Companies today often send offers through the mail that say you are approved for a new credit card. If you throw those offers in the trash, you risk someone committing mail fraud. They can pull out that offer and submit it in your name to get a card that you never even knew you applied for and one that you didn’t want. Scammers can also go through your mail and look for offers or new cards that companies sent to you. You may not even know that you missed that card until Aura shows you that someone opened a new account on your credit report.

New credit card scams target you, even if you don’t use your card online.

What are the Common Types of Financial Fraud?

Financial fraud is a danger that occurs when someone uses your financial information for personal gain. The number of cases of financial fraud increased significantly in 2020 and 2021 due to COVID. It may involve a scammer who uses deception to target an individual, but it can also include some type of threat or coercion. Many scammers target people who do not have much financial knowledge such as students in college or elderly people who are on fixed incomes. Aura offers protection against all of the common types of financial fraud, which you can learn more about below.

Mortgage Fraud

During the COVID pandemic, the federal government placed a moratorium on both evictions and foreclosures. This kept lenders from filing to take back homes and stopped landlords from kicking out their tenants. The moratorium led to an increase in the number of mortgage fraud cases as scammers called people and promised that they could help them avoid court cases. Mortgage fraud may ask someone who owns a home to pay a fee, which the scammer says will go to the bank but goes in their pocket. It can also claim that you can change or modify your loan and get relief as long as you make a payment today.

Charity Scams

You can come across charity scams in the street and when you’re sitting at home. One example is an individual or team who comes to your door and asks you to make a donation. They will claim that they cannot take cash and that they need your debit or credit card. The scammers will change the donation that you make to a higher amount, but they can also sign you up for monthly donations. While you might give them $100, they will keep charging your card for the same amount every month. They often use high-pressure tactics and try to push you to make a donation. You can encounter similar scams over the phone.

Prize Frauds

The prize fraud goes by other names, including lottery and sweepstakes scams. This is when someone calls and claims that you won a big prize but need to make a payment to claim it. Scammers may state that the money covers the administrative costs that they face or that it will pay the taxes on your prize. In addition to demanding your credit or debit card information, the scammer may ask for your bank account number to transfer the funds or request that you send gift cards to pay off the amount owed. You may find letters that come through the mail with similar claims, too.

Debt Collection

When you owe money to a lender and do not pay it back, the lender can make attempts to collect the debt. They will often use in-house services and then turn to debt collection agencies. A debt collection scam can claim that you owe money on an account you never opened or you owe a debt that you already paid. The statute of limitations for most debts ranges from seven to 10 years. Once the debt falls off your credit report, you are no longer responsible for paying it. Some companies will buy old debts for pennies on the dollar and make threats if you refuse to pay. As an Aura customer, you can make sure that those debts aren’t on your credit report.

Be very cautious about any unusual or suspicious calls that you receive to avoid financial frauds.

Should You Buy It?

We wanted to cover some of the top reasons why you should buy Aura. You can check out those reasons below.

White Glove Resolution

The number one reason to choose Aura is that you get while glove resolution. While this feature is only available with the Ultimate plan, it makes that plan well worth the cost. Let’s say that you learn you’re the victim of identity theft and have no idea what to do next. The thieves not only moved money from your bank account, but they opened several credit cards and obtained a boat loan. Aura ensures that you get the help you need when you need it. The company will assign a case manager to your account who guides you through the coming months. They’ll help you contact government departments and get in touch with law enforcement as well as unfreeze your assets and get your money back.

Freeze or Lock Your Credit Report

Whether you apply for a mortgage or a credit card, the lender will pull your credit. They want to make sure that you have a high credit score and a long history of paying back the money that you borrowed. Anything from an unpaid hospital bill to a defaulted credit card will show that you’re a bad risk and may prevent you from getting the loan. One benefit of working with Aura is that it lets you freeze or lock your credit report. If you notice some suspicious activity and believe that someone used your name, Aura will lock down your credit report to prevent lenders from viewing your history and giving someone else credit in your name.

Aura makes it easy for you to lock or freeze your credit report from any linked device.

Easy VPN Access

No matter which plan you choose, you get a VPN that is easy to use. With a virtual private network, you no longer need to worry that a hacker might follow you around on the web and trace your activity to steal personal information. The VPN uses a server located miles away from your home and allows you to change the location daily or whenever you want. Using a VPN also allows you to get around the blocks and restrictions that you may face. This includes an ISP that might stop you from using certain websites and governments that ban the use of streaming apps.

Antivirus Software

Though you can use free antivirus software or rely on the built-in protection offered by your web browser, you may still encounter some potential problems online. Aura is one of the only identity theft protection companies we found that includes antivirus software in all plans. You can use this feature on one device with the Basic plan or five devices with the Total plan. Those who sign up for the Ultimate plan get antivirus protection and a VPN that they can use on 10 devices. Aura offers antivirus support for Windows devices with plans to work with Android devices in the future.

When you become an Aura customer, you might get antivirus protection for your phone on top of your computer.

Our Favorite Things About Aura

- Tax refund alerts: Do you worry about missing a tax refund check when it comes in the mail but don’t want to give the IRS your bank account details? Aura has a tax refund alert that lets you know when the IRS issued a refund in your name. Not only can this give you an idea of when it might arrive in the mail, but it lets you know if someone claimed a refund on your behalf.

- Phishing protection for mobile devices: Browsing a phishing site is dangerous because it allows the person responsible to steal any information that you share. While many companies offer phishing protection for computer users, Aura helps you stay safe on your phone, too. It will block your device from reaching any site that it thinks is dangerous.

- Theft insurance: Though Aura cannot guarantee that no one will steal your identity, it guarantees that can get your money back. No matter what plan you select, you get theft insurance of up to $1 million. This covers any of the financial losses that you face.

- Three plans: As much as you hate the idea of losing money to identity theft, you probably also hate the idea of paying a company to keep you safe. Aura understands your concerns and knows that people have different budgets, which is why it offers three plans.

You can safely use your credit cards anywhere you go with the protection offered by Aura.

Cons to Consider

Limited Options

One of the biggest reasons to skip Aura is that it significantly limits some of the options that you get. The Basic plan is fine if you want to keep an eye on your online accounts and make sure that no one uses your ID numbers. It lets you get alerts when someone uses your SSN or driver’s license number. You will not get protection in the form of credit monitoring though, which is a big reason to sign up with an identity theft service. With the Basic plan, you get a single account that you can only use one device at a time.

No Free Trial

When we looked at other identity theft protection companies to compare them to Aura, we found that many have a free trial. You need to register for an account and tie a card to your account. The company charges your card when your free trial expires. Aura doesn’t offer this option. We recommend that you sign up for the Basic plan and see how Aura works. If you’re happy with that plan, you might like the Total or Ultimate plans even more. Aura makes upgrading to a better plan a breeze.

No Guarantee

Though Aura offers a $1 million insurance policy that pays out if you become a victim of identity theft, it doesn’t offer a guarantee on the services it offers. Let’s say that you sign up for the Ultimate plan and find that someone on the other side of the country opened several credit cards after you become an Aura customer. Aura makes no guarantees that its services will work for you. It also doesn’t promise that it can provide all of the alerts and notices that you need to stay safe. You can only work with Aura to get back any money that you lost because of the theft.

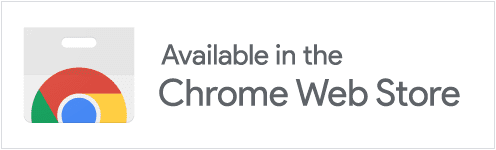

Credit Score

Your credit score is important because it shows lenders if they should loan you money or extend a line of credit. While an excellent score ranges from 800 to 850, a good credit score is between 670 and 740. If you have a score of 580 to the mid-600s, you have a fair credit score. An identity theft who uses your identity to open lines of credit they don’t pay can easily drop your credit score into the 500s or lower, which is a poor score. Though Aura lets you check your credit score, it only shows the score recorded by one bureau. The other two bureaus may assign you a significantly different score.

One Annual Credit Report

Looking at your credit report can help you see what lenders pulled your credit in the recent past and look for accounts that you don’t recognize. This helps you see new accounts that can indicate someone stole your identity. One of the downsides of working with Aura is that you can only look at your report once a year. While you might see your score dropping from one month to the next, you may not know why until you pay for your report. As there are three agencies that collect that information, you may find that other companies let you check each one more often.

What is a Good Credit Score?

Where to Buy

Are you ready to try Aura and see how it can help you? Click this link to load the page and sign up today. Our link allows you to learn more about how Aura works and some of the benefits of becoming a member. You’ll also find that you can save up to 40% on any of the plans when you use this link. Though you might think that you don’t need identity theft protection because you were a victim in the past, that doesn’t mean you won’t or can’t become a victim again. In the United States alone, one person becomes a victim of identity theft every seven seconds.

With our link, you can sign up for the Basic plan and pay only $8 per month or $96 for the year. The Total plan costs only $204 a year, which comes to $17 per month. You can also sign up for the Ultimate plan and pay $24 a month or $288 a year. If you aren’t sure which plan is the best option for you, make sure that you check out our comparison chart. We’ll show you which features come with each plan and which ones are only available with the Ultimate plan.

Competition

There are quite a few companies that offer identity theft protection and services that are similar to those available from Aura. We’ll take a quick look at the competition to give you an idea about some of the other choices you have.There are quite a few companies that offer identity theft protection and services that are similar to those available from Aura. We’ll take a quick look at the competition to give you an idea about some of the other choices you have.

IDShield

One option is IDShield, which tracks your credit score and monitors your credit report. It lets you know if you were part of a data breach and if there is anything that looks suspicious on your financial accounts. One benefit of working with this site is that you can sign up for free and try it out for 30 days before you pay for a plan. This is one of the few options we found with payday loan monitoring. If someone uses your information to take out a payday loan, you’ll find out right away. This is helpful as those loans have high-interest rates and can stay on your credit report for years.

LifeLock

LifeLock is one of the top identity theft companies in the world. Its founder often appeared in commercials where he revealed his SSN and credit card to show his trust in the company. This led to several lawsuits after it became public that he became a victim of identity theft due to those ads. LifeLock offers many helpful features such as dark web monitoring that tells you when your name appears on one of those sites. You can pick a plan with the limit that you want. If you are an identity theft victim, LifeLock will reimburse you for all of the money you lost up to your maximum limit.

Experian

Though you may know Experian as one of the primary credit reporting bureaus, it also offers protection to keep you safe. You can easily log in and view your current credit score and see how lenders view you. Experian offers monitoring of the two other bureaus to help you see how your credit score changes. It will also match you to credit card offers based on your history and let you freeze your credit report to keep others from seeing it. A new feature allows you to link your bank account and boost your score based on payments that you make every month.

Identity Guard

Another alternative to Aura is Identity Guard, which has an A+ rating with the Better Business Bureau. You get both dark web monitoring and monitoring of all three credit bureaus along with monthly reports. Those reports make it easy to see how your credit changes and stay on top of any potential issues. Identity Guard asks you to create a watch list of all the accounts you want to keep an eye on and gives you tips on how to limit your risks. You’ll also get alerts when suspicious activity happens and help to restore your identity. If someone steals your identity, the company will reimburse you.

Identity Defense

You may want to choose one of the three plans available through Identity Defense as well. Identity Defense offers a Basic plan for $10 per month up to the $25 per month Complete plan. The Complete plan is similar to the Ultimate plan offered by Aura. It includes both credit score reporting and credit bureau monitoring along with dark web monitoring. Thanks to social media monitoring, the company helps you see what information others can find on your Facebook and similar pages. You’ll get alerts when someone attempts to use or take over your bank account, too. This ensures that you get your account back from a hacker or scammer.

Final Verdict

Identity theft happens every few seconds in the United States. Once a thief gains enough information, they can use your identity to open dozens of credit cards and even secure loans for cars and other vehicles. It can take months for you to dig your way out of the financial hole that they left you in and even years. You may find that companies hold you responsible for the debt that the thief racked up until you can prove that the theft occurred and that local law enforcement isn’t as helpful as you would like. That is when Aura comes in handy.

Though it hasn’t been in business as long as some of its competitors have, Aura has a strong reputation for helping prevent customers from becoming victims of identity theft. We like that there are three plans available to fit all budgets and that customers can get coverage for as little as $10 per month. The extras that you get also make Aura worth the price, including a VPN that lets you do anything you want on the web and antivirus protection that works against all types of malware. Find the pros and cons as well as the top features of Aura before you sign up in our Aura review.